TOP >

Procedures of commercial and corporation registration for foreign nationals and expatriates

Procedures of commercial and corporation registration for foreign nationals and expatriates

In the case where a foreign national establishes a company in Japan, or where an officer of a company or corporation lives abroad, handling of registration procedure is as follows.

Residence of the representative director

The previous requirement that at least one of the representative directors in the domestic company has an address in Japan has been abolished. The application for the registration of incorporation of a domestic stock company and the application for the registration of change of representative director of the company will be accepted, even if all of the representative directors do not have addresses in Japan (the notice by Director of the Commercial Affairs Division dated as of March 16, 2015 (No. 29)).

Therefore, even if all the representative directors live abroad and they are not Japanese, the application for the registration of incorporation of a company in Japan will be accepted.

Therefore, even if all the representative directors live abroad and they are not Japanese, the application for the registration of incorporation of a company in Japan will be accepted.

Payment Certificate

If a stock company is to be incorporated by hokki-setsuritu, the method by which incorporators subscribe for all shares issued at incorporation (the method set forth in the provisions of Article 25(1)(i) of the Companies Act), a document evidencing the completion of payment of the contribution (Article 34(1) of the Companies Act) (a “Payment Certificate”) must be attached to the application for the registration of incorporation.

A document which contains the following two documents can be accepted as a Payment Certificate.

1. A document certifying the amount payed to the banks or other institution that handles the payment (the “Payment Handling Institution”) (Prepared by the representative director at incorporation or the representative executive officer at incorporation) *1

2. A copy of a deposit passbook of the Payment Handling Institution, or a bill of transaction, or other documents prepared by the Payment Handling Institution *2, *3

*1 If the amount is put by foreign currency deposit on the document, the following 2 items must be mentioned in the document 1.

(1) The exchange rate on the payment date (e.g.: At a rate of --- yen per dollar on DD MM, YYYY)

(2) The payment amount in Japanese yen calculated based on the exchange rate on the payment date.

*2 The printed transaction detail of the internet banking is included.

*3 All of the following must be mentioned in the document 2 (These may be mentioned in multiple pages.).

(1) Name of the Payment Handling Institution (With the branch office name where the bank account was opened)

(2) Contribution payment history

(3) Name of the account holder

A document which contains the following two documents can be accepted as a Payment Certificate.

1. A document certifying the amount payed to the banks or other institution that handles the payment (the “Payment Handling Institution”) (Prepared by the representative director at incorporation or the representative executive officer at incorporation) *1

2. A copy of a deposit passbook of the Payment Handling Institution, or a bill of transaction, or other documents prepared by the Payment Handling Institution *2, *3

*1 If the amount is put by foreign currency deposit on the document, the following 2 items must be mentioned in the document 1.

(1) The exchange rate on the payment date (e.g.: At a rate of --- yen per dollar on DD MM, YYYY)

(2) The payment amount in Japanese yen calculated based on the exchange rate on the payment date.

*2 The printed transaction detail of the internet banking is included.

*3 All of the following must be mentioned in the document 2 (These may be mentioned in multiple pages.).

(1) Name of the Payment Handling Institution (With the branch office name where the bank account was opened)

(2) Contribution payment history

(3) Name of the account holder

An account holder of the deposit passbook

1 An incorporator

2 A director at incorporation *4

*4 In the case where the director at incorporation is the account holder of the deposit passbook, a document clarifying that the incorporator has delegated the right to receive the payment to the account holder (a power of attorney or “POA”*5) must be attached to the application.

<Exceptions>

・ A person other than the incorporator and the director at incorporation (not restricted to a natural person , and including a juridical person) (a “Third Person”) may be accepted as an account holder of the deposit passbook

・ If a Third Person is the account holder of the deposit passbook, a POA which delegates the right to the Third Person must be attached additionally.

*5 POAs can be prepared by one or more incorporators.

Payment Handling Institutions

The Payment Handling Institutions include not only main and branch offices of domestic banks located in Japan, but also branch offices of foreign banks located in Japan (which are permitted by the Prime Minister to be established).Also, domestic bank branch offices located abroad are included (the notice by Director-General of the Civil Affairs Bureau dated as of December 20, 2016 (No.179)). Domestic bank branch offices will be shown in a certificate of registered matters of the bank.

However, note that overseas subsidiary established under the foreign law is not the domestic bank branch office, and is not included in the Payment Handling Institutions”.

〈The Payment Handling Institutions 〉

| Domestic bank main and branch office located in Japan (e.g.: Osaka branch of Tokyo Bank) | Yes |

| Domestic bank branch office located abroad (e.g.: New York branch of Tokyo Bank) *except overseas subsidiary | Yes |

| Foreign bank branch office located in Japan (e.g.: Tokyo branch of New York Bank) | Yes |

| Foreign bank branch office located abroad (e.g.: Boston branch of New York Bank) | No |

Signature certificate

A foreign national’s signature certificate attached to the application of commercial registration and corporation registration must have been made by competent authorities of the home country in the home country, but now competent authorities of the home country in any country may make certificates. (the notice by Director-General of the Civil Affairs Bureau dated as of June 28, 2016 (No.100), partially revised by the notice by Director-General of the Civil Affairs Bureau dated as of February 10, 2017 (No.15)).

<Attachable signature certificate (in the case of a foreign national A living in country B)>

* If there is any compelling reason why signature certificates made by competent authorities of the home country may not be obtained, the following signature certificates may be allowed to be attached.

Please refer to the notice by Director of the Commercial Affairs Division dated as of February 10, 2017 (No. 16) for specific examples of the compelling reasons.

Please consult the registry office which has the jurisdiction over the matter about the specific and concrete circumstances.

1 Signature certificate made by competent authorities of the country of residence

2 Signature certificate made by a notary of the country of residence

3 Signature certificate made by a notary of Japan

<Attachable signature certificate (in the case of a foreign national A living in country B)>

| Made by competent authorities of the home country in the home country (e.g. : Country A’s administrative organs in Country A) | Yes |

| Made by competent authorities of the home country in Japan (e.g. : Embassy of country A in Japan) | Yes |

| Made by competent authorities of the home country in a third country (e.g.: Embassy of country A in country B) | Yes |

| Made by a notary of the home country in his/her home country (e.g. :Notary in country A) | Yes |

* If there is any compelling reason why signature certificates made by competent authorities of the home country may not be obtained, the following signature certificates may be allowed to be attached.

Please refer to the notice by Director of the Commercial Affairs Division dated as of February 10, 2017 (No. 16) for specific examples of the compelling reasons.

Please consult the registry office which has the jurisdiction over the matter about the specific and concrete circumstances.

1 Signature certificate made by competent authorities of the country of residence

2 Signature certificate made by a notary of the country of residence

3 Signature certificate made by a notary of Japan

Translation of the attached document in a foreign language

When a document in a foreign language is attached to the application of commercial registration, as a general rule, Japanese translation must be attached additionally.

However, it can be omitted in certain cases.

Please refer to “Translation of Documents to be Attached to Applications for the Commercial Registration” for further details.

However, it can be omitted in certain cases.

Please refer to “Translation of Documents to be Attached to Applications for the Commercial Registration” for further details.

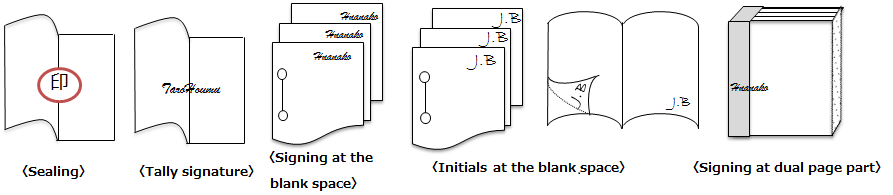

Sealing

When sealing on the registration application by a foreign company which is not registered as a foreign company under the provisions of the Companies Act, or a foreign national who cannot affix the seal impression, signature in one of the following ways is allowed instead of sealing.

1 Signing at each seam of two papers (So-called tally signature)

2 Signing at the blank space on each page

3 Handwriting initials at the blank space on each page

4 Signing at dual page parts (Both the front and back covers)